Printable Sales Tax Chart

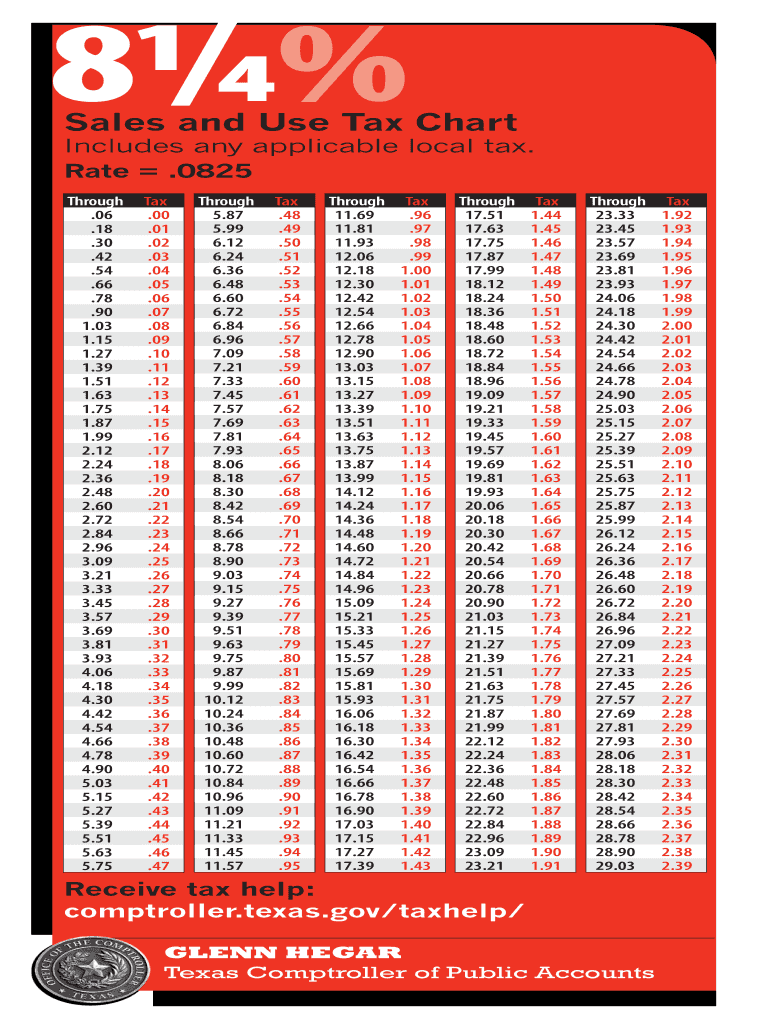

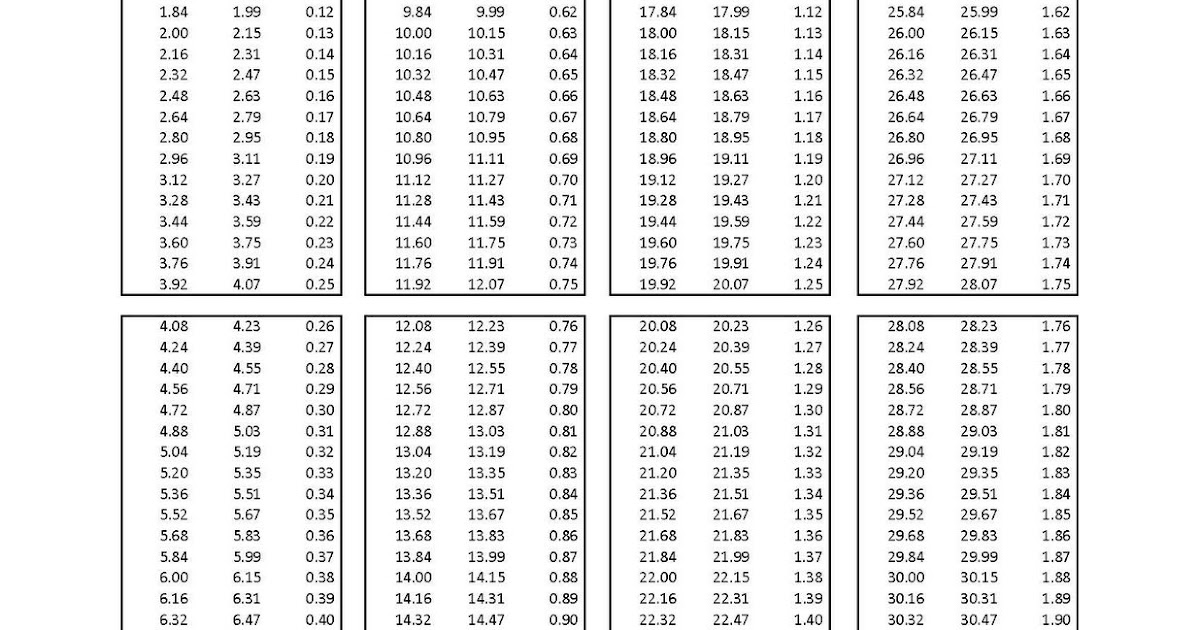

Printable Sales Tax Chart - How income taxes and property taxes are calculated; You can also calculate the total purchase price using the sales tax. Sales and use tax rate: The sales tax chart will popup in a new web browser. The following taxes are affected:. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a tax upon persons engaged in this state in the business of. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. Also, be aware that tax rates, as well. Save time and get accurate. Tax rate tables delivered via email monthly to keep you up to date on changing rates. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. 7% sales and use tax chart that is free to print and use. This chart can be used to easily calculate michigan sales taxes. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a tax upon persons engaged in this state in the business of. Also, be aware that tax rates, as well. You can print a 10.25% sales tax. This chart lists the standard state level sales and use tax rates. Many states allow local governments to charge a local sales tax in addition to the statewide. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. Sales and use tax rate: This chart can be used to easily calculate 9% sales taxes. Ideal for a quick calculation of tax on goods and services across various states. Tax rate tables delivered via email monthly to keep you up to date on changing rates. You can also calculate the total purchase price using the sales tax. Please review the results to ensure that the point shown is the intended location. Save time and get accurate. This is a printable michigan sales tax table, by sale amount, which can be customized by sales tax rate. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a tax upon persons engaged in this state in the business of. Ideal for a quick calculation of tax on goods and services across various states. A column for quantity will note down the quantity brought. Many states allow local governments. This chart can be used to easily calculate michigan sales taxes. A column for quantity will note down the quantity brought. There are a total of 514 local tax jurisdictions across the state, collecting. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax chart button. You. This chart can be used to easily calculate michigan sales taxes. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. Simply enter your state's sales and use tax rate in the form below, and click on the click here. Ideal for a quick calculation of tax on goods and services across various states. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. This chart lists the standard state level sales and use tax rates. You can print a 10.25% sales tax. Simply enter your state's sales and use tax. The following taxes are affected:. A sales tax percentage column can mention the tax rate imposed on the product. This chart can be used to easily calculate illinois sales taxes. This is a printable 9% sales tax table, by sale amount, which can be customized by sales tax rate. This is a printable ohio sales tax table, by sale amount,. This chart can be used to easily calculate michigan sales taxes. How income taxes and property taxes are calculated; Aarp’s state guides outline what the income tax, sales tax and other tax rates are in your state; You can also calculate the total purchase price using the sales tax. The tax rate displayed is for the point shown. Please review the results to ensure that the point shown is the intended location. This chart can be used to easily calculate ohio sales taxes. Ideal for a quick calculation of tax on goods and services across various states. A column that calculates the total. Tax rate tables delivered via email monthly to keep you up to date on changing. A column that calculates the total. This chart can be used to easily calculate illinois sales taxes. Ideal for a quick calculation of tax on goods and services across various states. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales. This chart lists the standard. This chart can be used to easily calculate ohio sales taxes. There are a total of 514 local tax jurisdictions across the state, collecting. Sales and use tax rate: Easily calculate the final price including sales tax with our sales tax calculator. Aarp’s state guides outline what the income tax, sales tax and other tax rates are in your state; Please review the results to ensure that the point shown is the intended location. Tax rate tables delivered via email monthly to keep you up to date on changing rates. The following taxes are affected:. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales. Download sales tax rate tables for any state for free. 51 rows generate a printable sales tax table for any city's sales tax rate to use. This chart can be used to easily calculate illinois sales taxes. This chart can be used to easily calculate michigan sales taxes. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. A column that calculates the total.Printable Sales Tax Chart

Printable Sales Tax Chart

Sales Tax Chart By State A Visual Reference of Charts Chart Master

Ohio Sales Tax Chart By County A Visual Reference of Charts Chart Master

Printable Sales Tax Chart Sales Tax Chart Printable Images

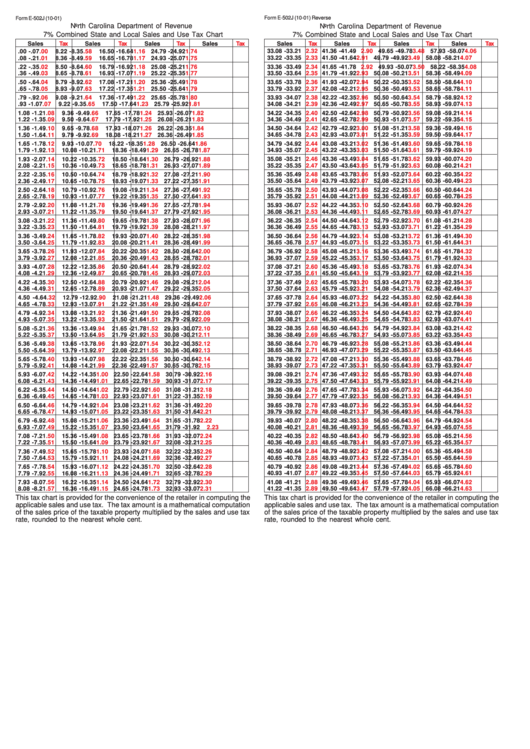

Nc County Sales Tax Rates 2024

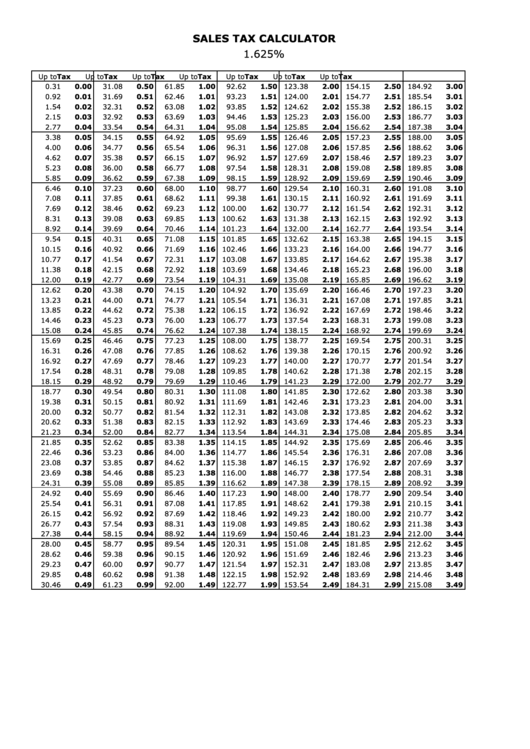

Sales Tax Calculator 1.625 printable pdf download

Sales Tax Chart Printable

Printable Sales Tax Chart

Printable Sales Tax Chart A Visual Reference of Charts Chart Master

Also, Be Aware That Tax Rates, As Well.

Ideal For A Quick Calculation Of Tax On Goods And Services Across Various States.

A Sales Tax Percentage Column Can Mention The Tax Rate Imposed On The Product.

Illinois Has State Sales Tax Of 6.25%, And Allows Local Governments To Collect A Local Option Sales Tax Of Up To 4.75%.

Related Post: